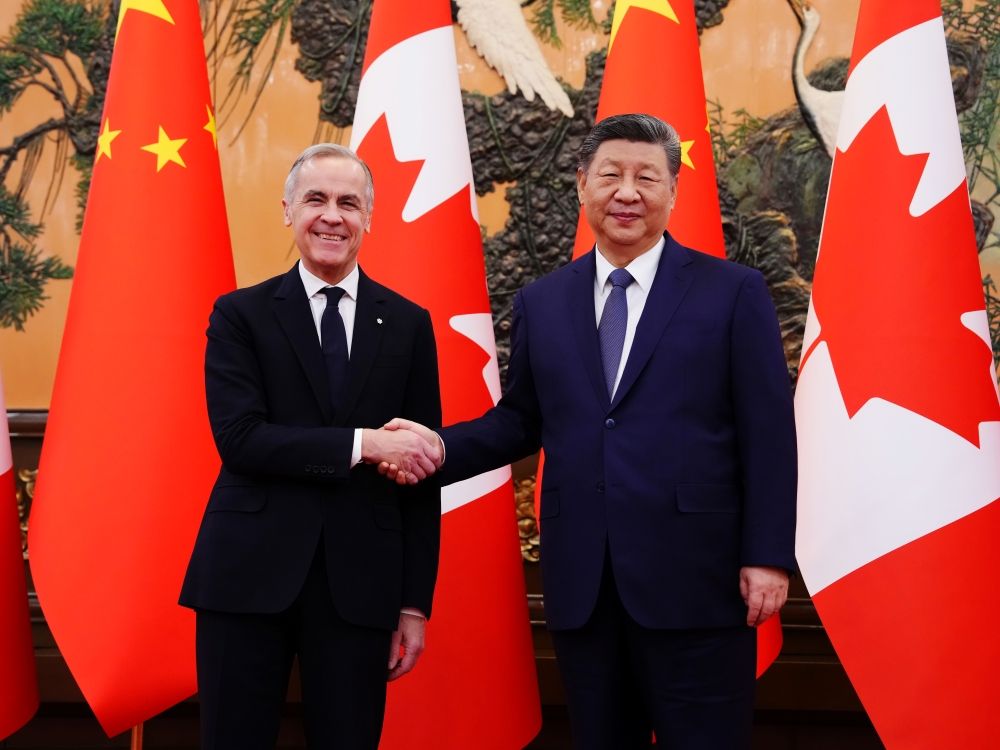

WASHINGTON, D.C. — Arrests, extended detainments, agricultural product bans, tariffs and expelled diplomats have been the hallmarks of Canada-China relations in recent years — and they formed the backdrop to Prime Minister Mark Carney’s historic trip late last week to Beijing.

But Carney made it clear he aimed to diversify Canadian trade, and while few geopolitical experts predicted much to come of his meeting with Xi Jinping, apart from initial discussions about electric vehicle (EV) quotas and canola tariffs, the two men struck a deal.

By March 1, Beijing is expected to cut its canola seed tariffs from 85 to 15 per cent and to exempt canola meal, lobsters, crabs, and peas from tariffs, which officials believe will unlock CA$3 billion in annual exports. Canada, for its part, will allow 49,000 Chinese EVs in at a tariff rate of 6.1 per cent — far lower than the 100 per cent EV tariffs imposed in 2024. Less tangibly, the countries have signed memorandums of understanding (MOUs) related to energy and clean tech that could lead to future deals.

“We are forging a new strategic partnership that builds on the best of our past, reflects the world as it is today, and benefits the people of both our nations,” the prime minister said Friday in a statement. He also noted to reporters in Beijing that the deal sets Canada up “well for the new world order,” noting that Canada’s relationship with China has become “more predictable” than its relationship with the United States.

So far, U.S. President Donald Trump has responded congenially.

“If you can get a deal with China, you should do that,” he said.

Still, with a review of the Canada-U.S.-Mexico Agreement looming this summer, and amid tariff threats over support for Greenland, the China deal comes at a precarious time. Could Carney’s inroads with Xi help or hurt him in his dealings with the White House — and could improved relations with China help him politically at home?

CUSMA in peril?

The president has suggested that he may not be that committed to CUSMA.

“There’s no real advantage to (CUSMA), it’s irrelevant,” Trump said last week. “Canada would love it. They need it.”

But would the president really undo what his first administration forged and labelled as the “gold standard” of free trade agreements?

Stephen Nagy, a senior fellow at the Macdonald-Laurier Institute and professor of politics and international studies at the International Christian University, said he expects the Trump team to see any China deal as a violation of CUSMA. He could see a world in which Trump pressures Carney to follow U.S. guidelines — against China — or threatens not to renew CUSMA.

“That’s bad for Canada. We trade about $900 billion a year with the United States, and 70 per cent of our trade is with the U.S., so losing that market — even just 10 per cent of it — would really hurt the Canadian economy.”

Others see the deal as genius.

“This is a master stroke,” said Reza Hasmath, a politics professor at the University of Alberta. “You’re able to get more joint ventures through more Chinese capital to Canada, you alleviate the issues you have with the Prairies, particularly canola trade, and when it comes to CUSMA … it gives [Ottawa] leverage because it shows Canada is looking for other markets.”

Hasmath does not believe the U.S. will abandon CUSMA, as that would be the “nuclear option.”

“You can threaten it … but to actually do it is a detriment to both our economies,” he said. “So we hope both sides are not going to press the nuclear button to do that.”

Still, the deal could lead to disagreements, particularly over Chinese access to the North American market and security.

Nagy, for example, pointed out that the Chinese EVs will mean not only disrupting the Canadian market but the broader market as well.

Whitney Lackenbauer, a professor and Canada Research Chair in the Study of the Canadian North at Trent University, looks at it through a security lens with a focus on the Arctic. He said the deal could pose some challenges in dealings with the U.S.

“In a way,” he said, “it is playing into certain primordial MAGA narratives about a country like Canada being unreliable or susceptible to Chinese influence.”

But Lackenbauer also noted that it’s a tradeoff in the sense that it shows Canada is diversifying its trade.

“Canada has had to do the unthinkable, which is buttress against American- or Trump-inspired economic uncertainty,” he added.

That defensiveness explains the China pivot, according to Anna Ashton, a China expert and head of Ashton Analytics.

“The last year of U.S.-Canada trade relations has been so brutal that, at this point, it seems predictably enough set on a negative course that I think Canada is looking to stop the bleeding and shore up big trade relationships where it can.”

She echoed Carney in saying that China offers trade relations with a more predictable partner.

“China may not be offering the kind of loyalty and alliance that Canada has had with the United States, but what it is offering is more predictability.”

Ashton also pointed out that the U.S. has not exactly been dealing with the U.S. on CUSMA matters in good faith.

“Even where [Canada] followed the letter of the agreement, the spirit of the agreement has been consistently violated by the U.S. side,” she said.

So a big CUSMA blowup is unlikely, but China brings its own traps, experts say.

Driving a wedge

Nagy warned that China’s concessions are part of an attempt to “drive a wedge” between Canada and the U.S., noting how, when Beijing’s partners align with them politically, they’re rewarded. When they don’t, China turns to economic or political pressure, as seen with tariffs, inspections, and hostage diplomacy, Nagy added.

Carney, he said, needs to be prepared for China’s charm versus coercion approach.

China may be letting Carney stick his toe in, but “they’re going to cut it off as soon as they have a chance,” Nagy warned. He pointed to China’s current strained relations with Japan as an example.

“Japan and China have terrible relations right now, and their economic relationship is worth about $300 billion,” he said.

“And [Beijing is] still willing to put pressure on the Japanese, because of a political disagreement, over the economic relationship.”

The Canadian relationship, meanwhile, is worth only a fraction of that, he said, referring to the CA$130 billion as merely a “drop in the bucket” to China.

In the future, China may resort to economic coercion with Canada, Hasmath acknowledged, noting that it cannot be stopped. Its impact, however, can be mitigated, he said.

“If China wants to use this sort of economic coercion … we can’t fully stop it, but we can reduce its impact.”

Canada can’t decouple from China, he said, without losing something like 20 per cent of the Canadian economy. But it can pursue a 10-20 year plan of derisking and pursuing the Indo-Pacific strategy, gradually reducing Canada’s economic vulnerabilities to China, including the over-reliance on some supply chains and markets.

But avoiding great power economic coercion, he said, does not mean needing to avoid China altogether.

“It’s done by all great powers,” he said.

Ashton agreed. “China can be coercive … that’s something that is well known by all of its trading partners,” she said, but the same is true of the United States.

“It was the Trump administration itself that pushed for the CUSMA deal, and it is the Trump administration that is kind of turning its back on CUSMA and trying to create a situation where it can demand and receive without reciprocating.”

Despite needing to diversify trading partners, Carney was also responding to domestic pressures with his China deal. Could his diversification efforts lead to an even bigger electoral win for the Liberals in the near future?

Domestic dividends vs. Conservative fodder

High Chinese tariffs on Canola have been hurting Western farmers, which is why Alberta, Saskatchewan, and Manitoba have wanted Canada to re-engage with China to boost agricultural exports.

The deal is a win for those farmers, and it could win some otherwise Conservative support for Carney’s Liberals as a result. Nagy said he expected this support to be limited, noting that conservatives he engages with personally were opposed to a China deal.

“They seem to be quite upset about the visit [to China],” he said, noting how Premier Scott Moe’s Conservatives are smaller in number.

While Western farmers wanted their market opened, the eastern provinces of Ontario and Quebec have been clear about preferring to keep their markets closed, and yet the new deal will see Chinese EVs hitting the Canadian market with comparably lower prices than domestic cars. That could be a win for consumers who can’t afford the higher-priced vehicles, but it could undermine domestic sales.

The deal will upset some, as it

has Ontario Premier Doug Ford

. But Hasmath described the political calculation as low-risk and high-reward. To his mind, the deal will appeal to the Prairies that need canola exports while likely not alienating Liberal strongholds in Ontario and Quebec.

If Carney can get joint-venture EV plans into Ontario ahead of a new federal election, said Hasmath, “he’s setting himself up to score a lot of political points.”

Will it pay off?

Carney’s approach to taking “the world as it is” — diversifying away from U.S. unpredictability, and closer to Beijing — is bold. This new deal should deliver much-needed revenue to the Prairies and, if EV plants can be built soon, could lead to automotive job growth. If so, and especially if Carney can keep CUSMA on track, the prime minister could be setting himself up for a majority Liberal win in the next election.

And if CUSMA talks go nowhere, some, like Nagy, have said this could potentially be good for Carney, too, at least politically.

“If [CUSMA review talks] go poorly, they’ll probably blame the Trump administration for everything. The Canadians will rally behind that, and I think that will be good for the Liberals,” said Nagy.

The CUSMA review looms this summer, and with Trump eyeing Greenland and threatening sanctions against allies, the real verdict will come in job numbers, affordability, business boardroom satisfaction, and, ultimately, Canadian ballots.

National Post

Our website is the place for the latest breaking news, exclusive scoops, longreads and provocative commentary. Please bookmark nationalpost.com and sign up for our newsletters here.