There have been many acceptable words and phrases used to describe a political leader. Some of them were positive, others were negative – and many were in the middle.

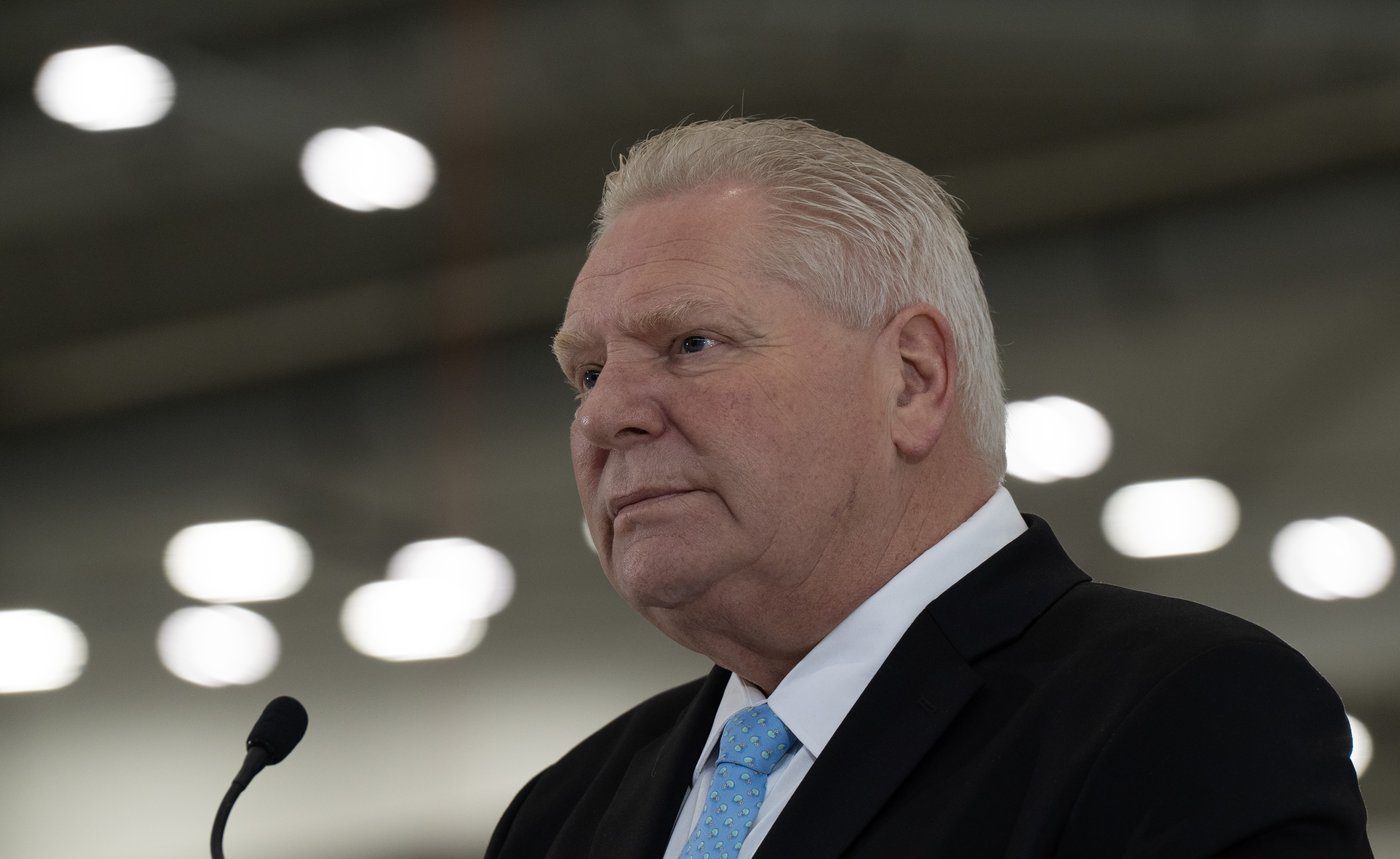

Ontario Premier Doug Ford’s description of Prime Minister Mark Carney as (wait for it) Santa Claus may have set a new standard. And not a good one.

The reference occurred during the First Ministers’ Meeting earlier this month.

“This has been the best meeting we’ve had in ten years,” Ford said at a press conference on June 2. “Simple. Best meeting I’ve had in seven years. And there was no expectations. The Prime Minister was going to say, ‘You get that project, you get that project.’ It was a great discussion.”

This part was fine. Ford’s first sentence was a veiled reference directed at former Prime Minister Justin Trudeau. He had not held a First Ministers’ Meeting between the Pan-Canadian Framework on Clean Growth and Climate Change being released on Dec. 9, 2016 and setting a political strategy to counter U.S. President Donald Trump’s tariffs on Jan. 15, 2025. (In fairness, these conferences and meetings have occurred less frequently in recent years.) The Ontario Premier’s description of his pleasure in attending this meeting, how projects were delegated and the positive tone of the discussion in the room was perfectly acceptable, too.

Ah, but he couldn’t leave well enough alone.

“I described him today as Santa Claus,” Ford said about Carney. “He’s coming, and his sled was full of all sorts of stuff. And now he’s taken off back to the North Pole, he’s going to sort it out, and then he’s going to call us. So…the only thing short of Santa Claus is my big belly, I got to loan it to him!”

Pardon me? What on earth was that all about?

Ford sounded unprofessional and foolish in front of the media. Comparing a personality-challenged Prime Minister to the generous spirit of Father Christmas made absolutely no sense. The lavish number of financial gifts that Ford was openly praising are also paid for by taxpayer dollars. If Ford is supposed to be a Conservative, which some of his critics in Project Ontario and elsewhere are beginning to seriously question, why would he applaud something like this?

Carney clearly got a kick out of it and was laughing right along with Ford. Who could blame him? When a Progressive Conservative Premier showers praise on a Liberal Prime Minister, it’s a huge win for the latter. As for the other premiers, I’d imagine their laughter was more forced than natural. They couldn’t do anything else at that moment.

Hold on. If the mood in the room was positive, wouldn’t that actually be to Ford’s advantage? Wouldn’t the self-deprecating comments about his big belly resembling Santa Claus prove that Ford has a playful nature to his personality? Why would Ford’s spontaneous decision to add a little levity to a press conference at a First Ministers’ Meeting be viewed as anything other than a good thing?

The overall answer is simple. While Ford was attempting to lighten the mood and add a little humour to the proceedings, this particular moment didn’t call for it.

If Ford wanted to discuss what he perceived as Carney’s generosity with the Premiers, there were better ways to do it instead of invoking Jolly Old Saint Nick. “I’m pleased that the Prime Minister wants to work with the provinces and create new programs that will help all Canadians,” he could have said. “This is the type of positive action and responsible government spending that Canada and our Premiers have needed for a decade,” he could have also said.

In other words, Ford should have acknowledged the gains made under Carney and also ensured that a fiscally conservative approach was maintained in his talking points to reporters. That’s a significant part of how he got elected, and it’s what many Ontario voters have expected from him while in office.

Here’s something else for Ford to think about. What if Carney, who is now his self-described Santa Claus, doesn’t hand out any of these wonderful presents on his sled from the North Pole…err, Ottawa? How do you backtrack from this ridiculously lavish amount of praise you just heaped on the Prime Minister? “Oops, I misspoke?” While I wouldn’t put this past Ford, it’s not going to make up for the fact that he travelled on a particular road that he could have easily avoided.

As someone who’s worked in politics, this is the type of mistake that could haunt you for years. It will always be easy for opposition leaders, parties and research departments to dig up this video clip. They’ll be able to use it to their political advantage in various ways. There’s no way to ever erase it from our memory banks, either.

With apologies to Clement Clarke Moore, this was a visit from Saint Nicholas that Doug Ford shouldn’t have wished for.

Michael Taube, a longtime newspaper columnist and political commentator, was a speechwriter for former Canadian prime minister Stephen Harper.