This content is restricted to subscribers

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.

This content is restricted to subscribers

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.

This content is restricted to subscribers

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.

This content is restricted to subscribers

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.

This content is restricted to subscribers

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.

This content is restricted to subscribers

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.

This content is restricted to subscribers

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.

This content is restricted to subscribers

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.

This content is restricted to subscribers

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.

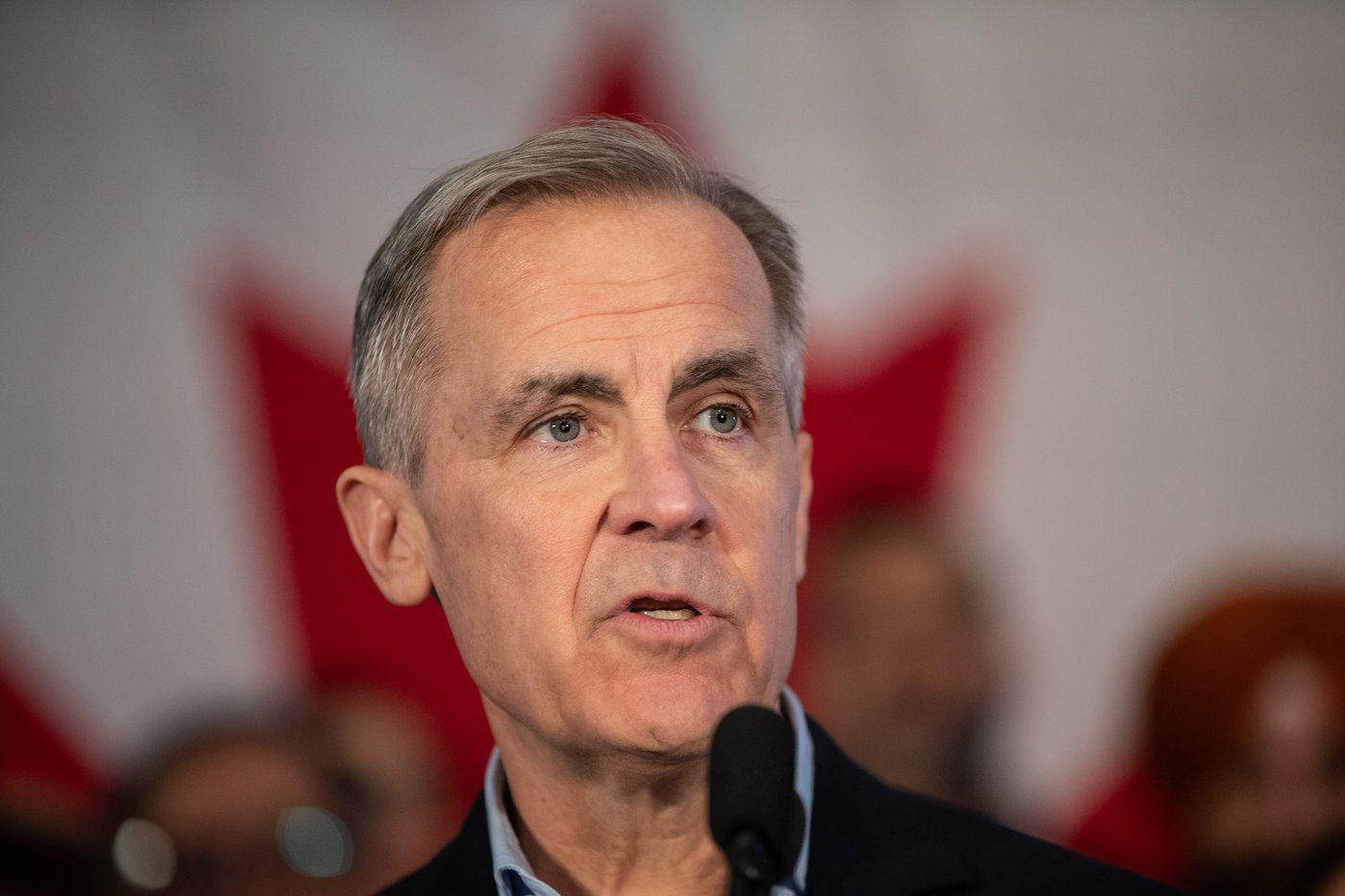

A funny thing happened on the way to the Mark Carney coronation. He turned out to be terrible at politics. Mysteriously, chronically, who-thought-he-was-a-Liberal-saviour terrible. How did he do it? I genuinely don’t know.

Perhaps his acolytes would say it’s because he’s an outsider, not the sort of professional politician who’s been afflicting us constantly unless you count Justin Trudeau or Michael Ignatieff. Perhaps we’re meant to savour his authenticity.

The trouble is, he’s shockingly inauthentic. Right down to his claim to be an “outsider” after chairing not one but two central banks, graduating from Harvard and Oxford, rocketing to the top at Goldman Sachs, being “senior associate deputy minister and G7 deputy in the Department of Finance Canada”, and also “chairman of the Bank for International Settlements’ Committee on the Global Financial System” as well as “a member of the Group of Thirty… and of the Foundation Board of the World Economic Forum”, regularly attending Bilderberg Group gatherings, chairing the Swiss-based Financial Stability Board and serving as “United Nations special envoy for climate action and finance” before taking over Brookfield Asset Management and Bloomberg L.P.

Oh, and being a key economic advisor to Justin Trudeau, something I can understand him not touting prominently at this point. But apart from all that stuff he’s just a former amateur goalie from Fort Smith, honest. A regular guy who poses nostalgically in $2,000 shoes. One of us.

Pfui. I get that we can’t all live in log cabins. And it’s OK to be rich, successful, even cultured. In fact I always sympathized with John Kerry’s infamous request for Swiss on his Philly sandwich, because the neon orange stuff is gross. But if it’s who you are, don’t pretend you’re not. Especially if you’re bad at it. I’d have requested provolone, and stood by it.

Normally I might give that advice in a fundamental life-coach be-honest-above-all way. And risk a chorus of sneers for posing as a credible life coach. But in this case I give it in a shallow political-advisor only-tell-slick-lies way. And risk a chorus of sneers for posing as a credible political advisor.

I have occasionally been approached by some desperate party about running for them and I reply, quoting Pogo, that “We can lose in easier ways.” But surely in the course of his meteoric rise to international fame, including stints in the public sector as well as a long and worrisome career in the parastatal sector, Carney’s had some occasion to observe politicians, note their foibles and develop some opinion on what they do and how and even how he could do better.

He’s not exactly shy. OK, he is a terrible public speaker, emanating the dreaded amsirahc. But did he not know that, as was said of Senator Henry Jackson, if he gave a fireside chat the fire would go out, and realize he needed a plan to overcome it? Just possibly the one where you roll with it, saying yes, I’m not slick and shallow like some Trudeaus I won’t name, I’m a high-flying, economically brilliant, successful international man of greenery which is just what you need now, not some blundering hack or amateur?

Instead he appears to have delegated comms to teenager staffers nobody else wanted. I grant that a lot of political parties are struggling these days. For instance I wouldn’t hire Jagmeet Singh’s PR team even at a steep discount. Unless the only other applicants were Carney’s.

I mean, take this tweet… please. A giant splashy red graphic saying “WHO’S THE WORST PERSON TO STAND UP TO DONALD TRUMP? PIERRE POILIEVRE. HE WORSHIPS THE MAN. – MARK CARNEY”. Um, no. You say that kind of stuff over beer after a hard day spinning. You don’t put it out as the spin.

Likewise, was there nobody to tell him sir, if you’re doing that outsider thing, and I advise against, it, check the wardrobe before getting in front of a camera? A lot of people don’t even know there are $2,000 men’s casual shoes, let alone own any, and it might cause talk. And then there’s the lie about quitting Brookfield before it moved its HQ from Toronto to New York.

I’m no naïf. I don’t expect politicians to tell the truth all the time, or know what it is most of the time, or care. What bothers me about this one is that it was bound to blow up in his face. What he said, typical of short-pants-brigade focus-grouped spin, was “I resigned all my positions because I am all in for Canada, all in for this leadership, all in during this time of crisis to build our great country, okay? That’s the first thing. Second, the formal decision of the Board happened after I ceased to be on the Board.”

Riiight. Except for the letter you wrote to shareholders advocating the move on December 1, after the decision was announced Oct. 31. The public letter. Which even lacklustre opposition research will unearth within hours, and no amount of paid media can entirely deny.

Sure, the Globe and Mail headlined the story “Conservatives accuse Mark Carney of misleading Canadians about role in Brookfield’s move to New York” as though it were a he said/she said. “Conservatives catch Mark Carney lying” would have been more concise and a lot more accurate, if less state-subsidy-friendly. But there was no possibility of denying the episode.

Can Carney find nobody capable of warning him against such elementary blunders? Will he not listen? Or does he think nobody cares if Liberals lie brazenly? Sadly, the last if true might be the most worldly. But my main impression is that a lifetime spent rubbing greasy elbows with politicians taught him nothing about them, or himself.

Of course the acolytes might again say yeah, sure, our guy’s no politician, and it’s a feature not a bug. He’s a technocrat who can make the economy and the government work. But where’s the beef on that one?

True, he can point to his career as proof that people like him like people like him. But his actual as opposed to rhetorical performance as governor of the Canadian and British central banks is nothing spectacular, and his claim to have personally helped Paul Martin balance the 1998 budget is another silly lie as his own biography says he was an economics student at Oxford at the time.

Which brings me to another weird problem. Many people who are economists lack the popular touch and go about calling branches of their field “public choice theory” or labeling unearned income “rent” or naming their feeble amateur baseball team “the marginal utility players”. (OK, the last was me, and it was unjustly voted down.) But one thing they do have is strong, consistent opinions in one area, namely… drum roll please… economics. Yet here again Carney babbles predictable focus-grouped word salad without anything resembling a coherent world-view or originality, let alone the courage of his convictions. Who devised this cunning plan? And why?

For myself, on the “lose in easier ways” front, I’m a dedicated libertarian on policy who would campaign on unilateral free trade, drastically simplifying the tax system, balancing the budget by cutting social programs that foster dependency, and tripling defence spending because I’m also a dedicated hawk. And I’d get 0.03% of the vote, admittedly a bit awkward if you’re worldly, cynical and want to lie your way into power in order to implement policies you abhor and lose the next election anyway. Like say Pierre Poilievre. Or Stephen Harper. But what of Mark Carney?

A long-time advocate for Net Zero, organizer of a crumbling international banking cabal dedicated to it, he can’t even seem to make sense when explaining that he’d carbon-tax producers not consumers and the costs would evaporate instead of being passed along. He babbles early-1980s-airport-paperback generalities about competitiveness through big government, and trips over his own tongue. He stammers trendily crowd-pleasing banalities about curtailing immigration and excessive government spending, but has no practical plans for fixing either and no explanation of where he was on all this stuff until the public mood shifted. And he never saw it coming, and neither did his entourage.

The Liberals may yet crown him, being so obtuse and ahistorical that even the name Kamala Harris means nothing to them, let alone Michael Ignatieff. But aren’t they even slightly worried that he’s so clueless about his own shortcomings either as campaigner or as policy architect?

I don’t expect him to agree with me on policy or on running an honest, plain-talking, principled campaign. Not even the Conservatives do. But I am stunned that a lifetime in the public arena, exhibiting considerable intelligence and people skills, should have left him so dramatically clueless as a candidate.

It even makes me wonder about the circles in which he enjoyed such a glittering career. And I certainly don’t understand how he made such an atrocious pivot into politics. It can’t have been easy, and it wasn’t worthwhile.

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.

This content is restricted to subscribers

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.