This content is restricted to subscribers

This content is only available to our subscribers!

Become a subscriber today!

Register

Become a subscriber today!

Register

This content is restricted to subscribers

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.

This content is restricted to subscribers

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.

This content is restricted to subscribers

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.

Thanks to Blaine Higgs’ strong management, New Brunswick’s debt is at historically low levels and the province is now positioned to cut taxes in a historic way.

As Higgs seeks another mandate this year, now is the time for him to maintain his signature fiscal prudence and couple it with a tax relief agenda that would put New Brunswick on the map as one of the lowest-taxed destinations in Canada.

Just five short years ago, New Brunswick’s debt was spiralling out of control and the idea of tax relief seemed like a distant dream.

The year before Higgs was elected, former premier Brian Gallant increased New Brunswick’s net debt by more than $1 billion as his government ran the province’s tenth straight deficit. Money spent on interest charges alone exceeded New Brunswick’s post-secondary education budget.

Today, New Brunswick leads the nation when it comes to sound financial management. Between 2018 and 2023, Higgs led the only government in Canada that posted a surplus every year, including throughout the pandemic.

As Higgs enters his sixth year in charge of the Legislative Assembly, New Brunswick is poised to run its sixth consecutive surplus. Higgs also managed to lower New Brunswick’s debt by more than $2 billion.

New Brunswick’s debt-to-GDP ratio has declined from more than 40 per cent (when Higgs took office) to roughly 25 per cent today, one of the lowest levels in Canada.

And consider this: as most provinces and the feds have seen their debt interest payments soar due to higher interest rates, New Brunswick’s interest charges have gone down. Since Higgs has repaid so much debt, New Brunswick will spend $70 million less this year on debt interest charges than it did the year before Higgs took office.

After years of careful management, it’s now time for Higgs to deliver on historic tax relief for New Brunswickers. He should do so by slashing the sales tax.

At a time when taxpayers are confronting higher prices virtually everywhere and living costs remain high, lowering the HST would allow New Brunswickers to save money on almost everything, from gas to clothing to home heating.

A report recently released by the Fraser Institute suggests that New Brunswick could afford to start lowering the sales tax this year and eliminate it altogether over the next decade so long as politicians in Fredericton maintain Higgs’ cautious approach to government spending.

A fully implemented phase out of New Brunswick’s 10 per cent sales tax would save the average New Brunswick family $4,100 a year.

Higgs could make a start by cutting the HST by two percentage points this year in his 2024 budget. That move alone would save the average New Brunswick family $820 a year.

This October, New Brunswickers are scheduled to go to the polls. Higgs has built a strong record over the past five years. He’s slashed the province’s debt and introduced modest income tax cuts. But if Higgs wants to truly make his mark on the province, he must deliver significant tax relief.

New Brunswick families are dealing with many of the same struggles taxpayers across Canada are facing. More than 50 per cent of families say they’re $200 away from not being able to pay their bills. Nearly 1.1 million Canadians are working multiple jobs just to make ends meet.

Families could benefit immensely from a sales tax cut that would put hundreds of dollars back in their pockets. Thanks to Higgs’ careful management over the past five years, New Brunswick is positioned to deliver exactly that.

The time for Higgs to pull the trigger on tax relief is now.

Jay Goldberg is the Interim Atlantic Director of the Canadian Taxpayers Federation

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.

Become a subscriber today!

Register

This content is restricted to subscribers

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.

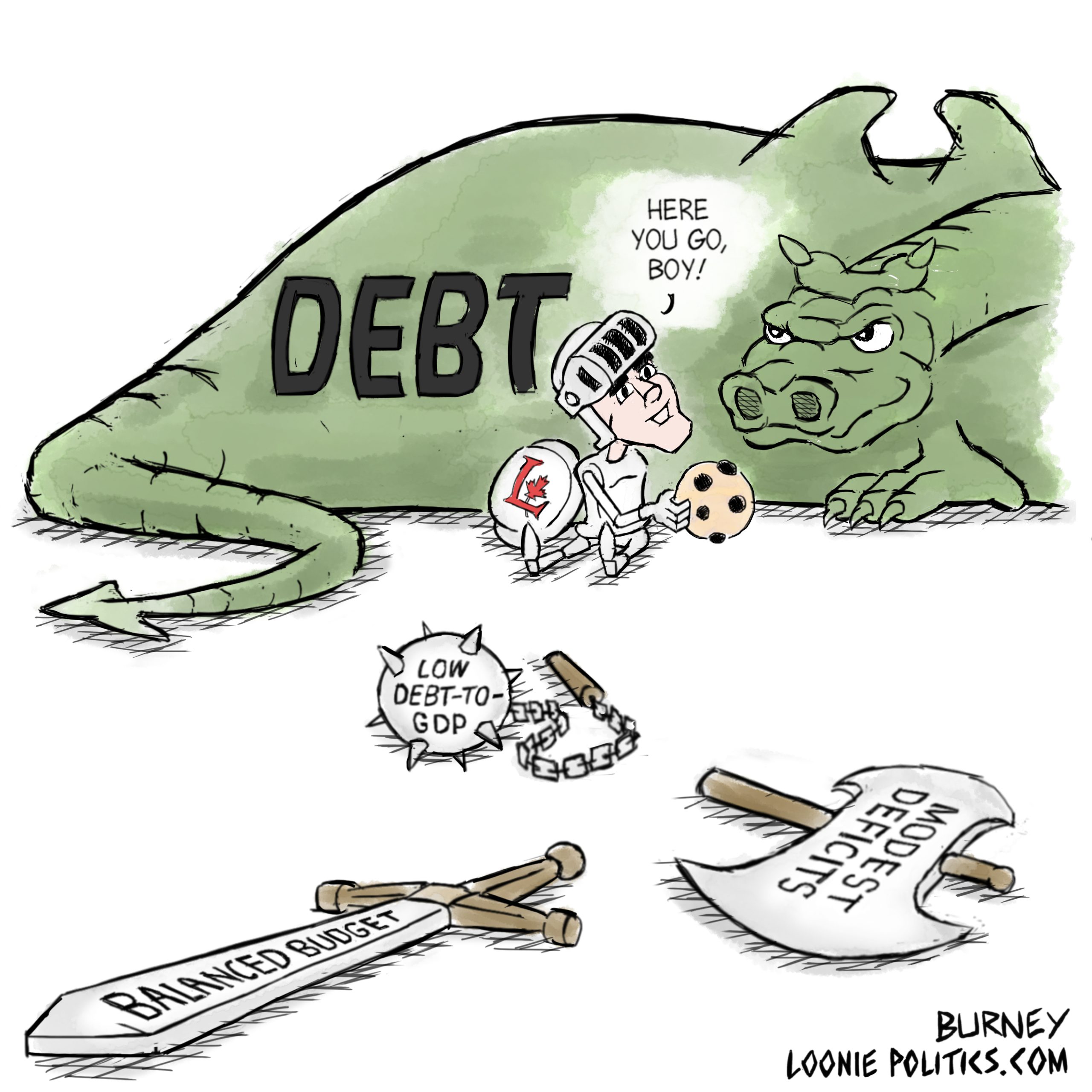

It’s time for Ontario taxpayers to hit the debt panic button.

The Parliamentary Budget Officer released a troubling report earlier this month that shows that when Ontario’s provincial and municipal finances are looked at together, Ontario will be running deficits indefinitely, until at least the year 2095.

Typically, when analysts look at the state of government finances in Ontario, they either look at provincial or municipal forecasts.

But the PBO chose to look at the fiscal trajectory of the entire province, municipalities included.

Why would the Parliamentary Budget Officer factor-in finances at the municipal level?

The Canadian constitution gives the provinces sole authority over municipalities. Unlike the federal or provincial governments, municipal governments have no constitutional status.

They are created by provincial governments and can be disbanded by provincial governments.

Look no further than the amalgamation of Toronto, or Premier Doug Ford’s decision to cut the size of Toronto city council in half.

The fact that provincial governments have authority over municipalities also means that they are responsible for them. Any debts taken on by Canadian cities and towns would become the responsibility of the provincial government should a municipality, for whatever reason, be unable to pay them.

Therefore, it makes perfect sense for the PBO to look at the debt of Ontario governments collectively.

It also means that all of these debt bills, municipal, provincial, and even federal all fall onto the same taxpayer.

In the Ford government’s 2021 budget, Finance Minister Peter Bethlenfalvy predicted that the province would be able to balance its budget by the end of the decade.

While the Ford government should work to balance its budget much sooner, the province’s numbers do show a trajectory toward a balanced budget, which is good news.

But when the finances of Ontario’s municipalities are included the equation, Ontario collectively is not projected to balance its books at any point between now and the year 2095, the end of the Parliamentary Budget Officer’s forecast.

Some may wonder how the spending at city halls could throw the budget numbers off, given that Canadian cities and towns are not allowed to run operational deficits.

Operational is the key word: municipalities must balance their budgets that deal with day-to-day expenses, but they have a separate capital budget that accounts for major infrastructure spending. Capital budgets are allowed to be in deficit.

Consider the 2021 budget approved by Toronto city council. While the operational budget is balanced, the city plans to borrow $1 billion to pay for capital projects this year. The plan also includes another $1.4 billion of capital spending debt, to be taken on over the next two years.

Toronto’s latest data also shows that the city’s debt stood at over $7 billion in 2019, having increased by over $2 billion over a three-year period.

Toronto is just the tip of the iceberg. All of Ontario’s 444 municipalities also take on debt to pay for capital projects such as transit tunnels, bike lanes, and garbage collection centres.

That goes a long way to explain why even if Queen’s Park balances its budget by the end of the decade, Ontario overall will continue to accumulate debt.

The fact that Ontario’s governments are set to collectively spend more than they take in every year for the next seven decades should alarm every taxpayer. Annual payments on debt interest alone are projected to exceed $180 billion by the year 2095.

Ontario taxpayers deserve better. It is high time that we begin to consider the risks associated with allowing municipal governments to run deficits to finance capital spending. Should any of Ontario’s 444 municipalities be unable to pay its bills, Ontario taxpayers will be on the hook.

For the sake of the next generation, Ontario governments need to get their financial houses in order and find a way to escape a decades-long debt spiral.

Jay Goldberg is the Interim Ontario Director at the Canadian Taxpayers Federation

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.

This content is restricted to subscribers

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.