Prime Minister Justin Trudeau’s carbon tax consensus within his Liberal party is collapsing.

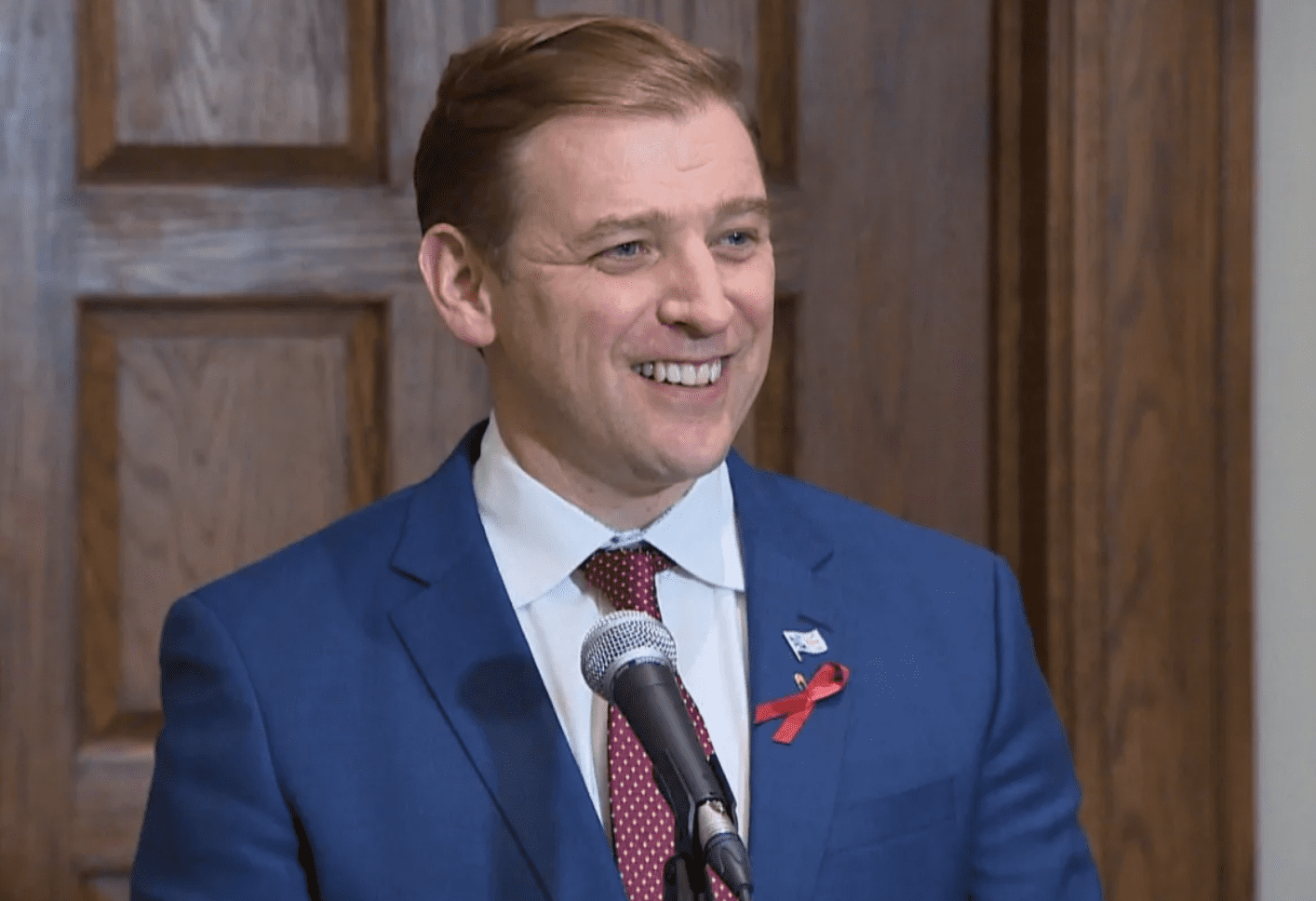

Newfoundland and Labrador’s Liberal premier, Andrew Furey, might end up being the man who finally takes down the Trudeau carbon tax.

After months of trying to get Trudeau to be more flexible on the carbon tax, Furey has come out against the policy altogether.

Let’s look back at how this came to be.

It’s no secret that opposition to the Trudeau government’s punishing carbon tax was strong early on and has been growing ever since.

But a large chunk of that opposition was concentrated among conservative politicians.

Premiers like Doug Ford in Ontario, Blaine Higgs in New Brunswick and Scott Moe in Saskatchewan have all been calling on the Trudeau government to scrap the federal carbon tax since they came to power in 2018.

But until recently, Trudeau had the tacit support of most Liberal politicians at all levels.

As Trudeau has hiked his carbon tax further and further, Liberal politicians couldn’t keep selling the scheme, especially for constituents who don’t live in tiny condos in downtown metropolises.

The federal carbon tax now costs drivers 17 cents per litre at the gas pump and homeowners with natural gas are paying than $300 this winter. The federal government plants to keep raising the carbon tax until 2030, so it’ll only get worse.

Over the past year, Furey, Canada’s lone Liberal first minister, has gone from supporting Trudeau’s carbon tax to becoming an outright antagonist.

Last year, Furey called on the federal government to stop charging the carbon tax on home heating oil, which a large percentage of Newfoundlanders and Labradorians use to heat their homes.

Soon thereafter, Newfoundland and Labrador Member of Parliament Ken McDonald courageously voted to repeal the federal carbon tax and nearly launched a rebellion in the Liberal caucus among Atlantic Liberal MPs. In response, Trudeau carved out a carbon tax exemption for home heating oil for the next three years.

But Furey wasn’t satisfied.

In the lead up to the Trudeau government’s 2024 carbon tax hike, which occurred on April 1, Furey signed an open letter to Trudeau calling on the federal government to cancel its planned hike. Six other premiers joined him in that effort.

Yet Trudeau was defiant and let the 23 per cent carbon tax increase go ahead.

That’s when Furey threw down the gauntlet.

In a letter to Trudeau, Furey declared openly what the vast majority of Canadians already know: the carbon tax is the wrong approach when it comes to protecting the environment.

Unlike Canadians living in downtown Toronto or Vancouver, with tiny condos and easy access to public transit, Furey notes Newfoundlanders and Labradorians can’t still need to drive to work and heat their homes no matter how high the carbon tax goes.

The idea behind the carbon tax is that as prices get too high, consumers change their behaviour and use less carbon intensive methods to heat their homes and get to work.

But those living in rural Canada can’t hop on the subway or rely on a heat pump.

Furey notes in his letter that for many, “there are no alternatives available.” So, if Trudeau’s goal is to use the carbon tax to lower emissions, that goal “is not being achieved at this time.”

Furey concludes: “We need a constructive approach to decarbonize our environment without placing the burden on individual families who simply do not have viable alternative options.”

Furey is calling on Trudeau to convene an emergency meeting of Canada’s premiers to search for alternatives to the carbon tax.

Seventy per cent of Canadians opposed Trudeau’s carbon tax hike on April 1. It’s a good bet that number will keep going up every time the tax goes up. Furey is right to point out that obvious reality and the prime minister should listen.

Jay Goldberg is the Interim Atlantic Director of the Canadian Taxpayers Federation