The Conservative Party's plan to peddle its own version of a carbon tax is the worst idea since the Ford Motor company decided to manufacture the Edsel. (Millennials should substitute Edsel with Quibi.)

Now, before I go on with this rant, let me first clarify a few points.

First off, when I say the Conservative carbon tax plan is a bad idea, I don't mean it's bad environmental policy, since I'm not qualified to make such a judgement.

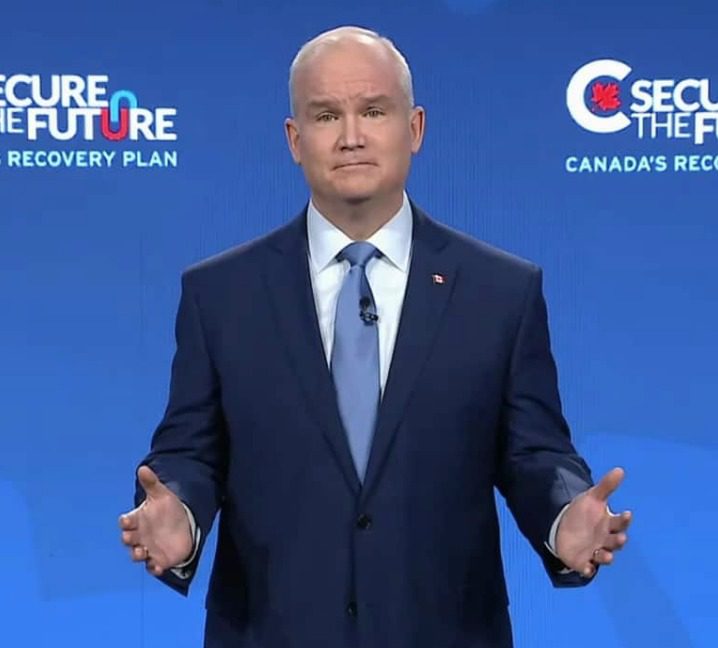

I'm simply judging this policy the same way I judge all political policies, from a cynical, jaded, world-weary perspective, which I think is fair, since, let's face it, I doubt Conservative Party leader Erin O'Toole decided to go this route because he suddenly experienced a "road to Damascus moment" and became a Born-Again environmentalist.

Rather, he's channeling Greta Thunberg right now because, for some reason, he thinks imposing a Liberal-style green tax will help him win the next election, which means he must be listening to the advice of media pundits the same media pundits who firmly believed Doug Ford would lose the 2018 Ontario election because he opposed the carbon tax.

Anyway, the second point I want to make is I'm not going to beat up O'Toole for flip flopping on this issue.

Just because he was recently opposed to a carbon tax, doesn't mean he should always be opposed to the idea.

After all, O'Toole can always say something like, "I was wrong before; but now I'm right." And hey, being right 50 percent of the time is a good batting average for any politician.

So, why do I think O'Toole's scheme is ludicrous, half-baked and dopey?

Well, for many reasons, but mainly because it's needlessly convoluted.

Instead of just saying, I'm going to copy Prime Minister Justin Trudeau's tax and rebate scheme, the Conservatives have come up with a complicated program whereby the extra price people pay for gasoline, thanks to O'Toole's carbon tax, will go into a mandatory savings account, which people can tap into but only to purchase government-approved "green" products.

In other words, the money O'Toole will force you to save would only be good for buying things such as solar powered windmills, eco-tote bags and David Suzuki's autobiography.

Oh, and O'Toole's plan also includes a complex array of new regulations on businesses, plus a tax on frequent fliers. (Reminder: conservatives in O'Toole's base typically don't like regulations, taxes or anything that's mandatory.)

Of course, members of the Conservative Party's consulting class don't see any of this as a problem.

Indeed, I see them on their Twitter proudly retweeting comments from green policy experts and from economists, and from media pundits who are saying stuff like, "After carefully analyzing all the various components of O'Toole's bold green tax plan, I hereby declare it to be not terrible."

But if anybody in the Conservative Party actually thinks the average Canadian voter is going to carefully analyze its plan, their dreaming in technicolor. (Fun fact: if the media has to print articles explaining how a policy will work, it means it's too complicated to be a tool of persuasion.)

All people will know about this plan is A) the Conservatives now favour higher taxes and B) they will lose the current system whereby they get carbon tax rebates which they can spend anyway they want.

I don't know about you, but I don't see that as an instant crowd pleaser. Certainly, it won't please O'Toole's own base.

Keep in mind, a good policy (at least from the perspective of a cynical political strategist) is one that's simple to understand and that mobilizes your base while dividing your opponents.

For instance, when former Conservative Party leader Stephen Harper promised to cut the GST, that was a good simple policy that pleased all Conservatives and may have tempted Liberals.

O'Toole's green plan won't do that it'll likely do the opposite, i.e. alienate conservatives and bore Liberals.

Yes, all those green experts and economists and media pundits who are half-heartedly praising O'Toole's new carbon tax plan, will still vote Liberal.

The fact is, no matter how hard he tries, O'Toole — despite his Irish heritage — will never out-green the Liberals.

Photo Credit: CBC News