Having declared victory after pushing on an open door and taking credit for actions the government was going to take already in the lead-up to the Speech from the Throne, the NDP have set their sights on so-called "profiteers" who have committed the sin of making money over the course of the current pandemic. And to be sure, there have been some very problematic choices by some of these companies, like the decision to cut the "hero pay" of front-line grocery workers, but nothing the NDP suggests would actually be a suitable fix for what happened.

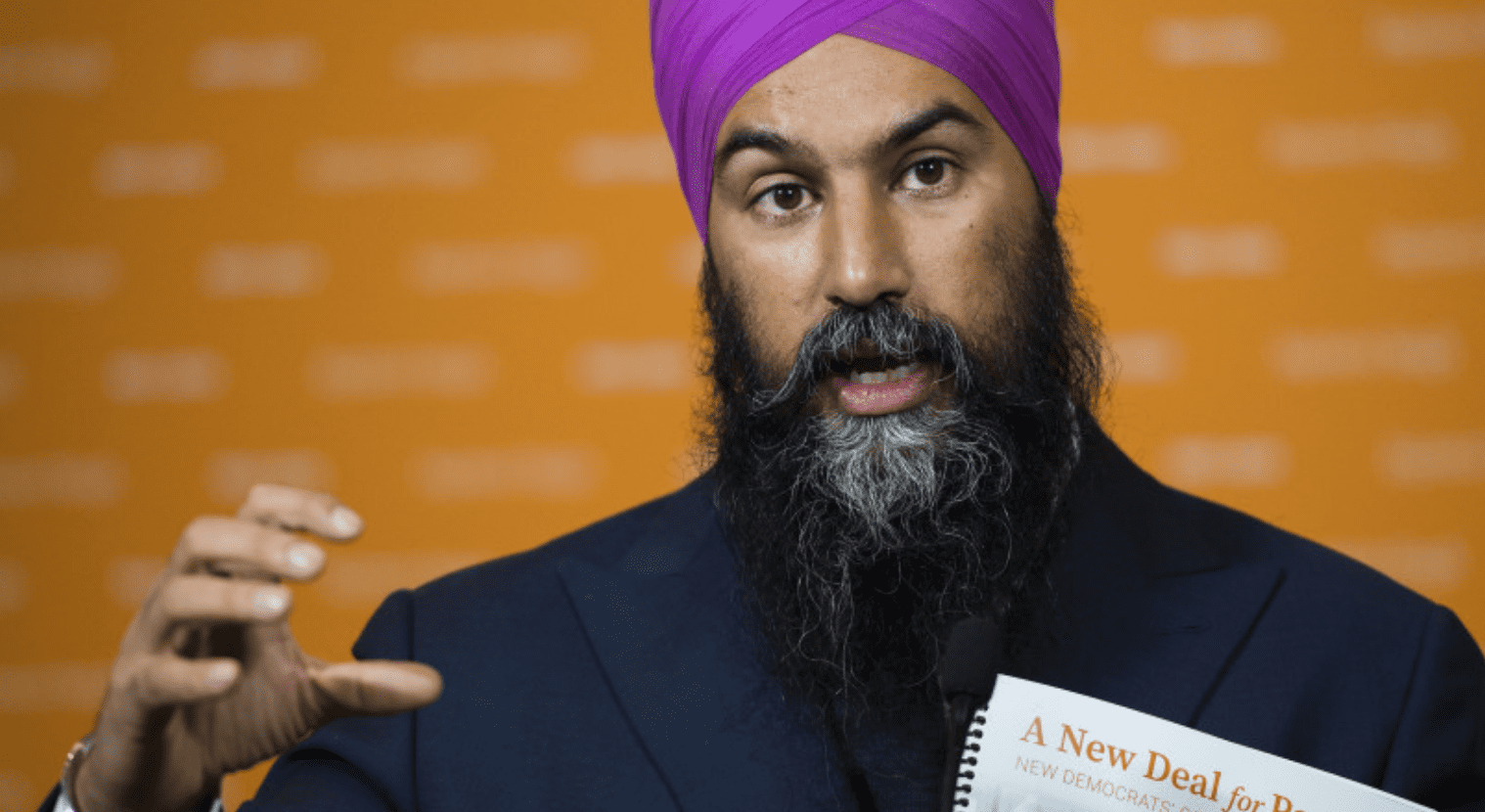

The NDP have proposed a suite of measures that they say will ensure that the "richest elites and most profitable corporations" pay their fair share, and leader Jagmeet Singh has raised the spectre of this being preferable to a GST/HST hike to pay for the deficits that have accumulated as a result of emergency measures something that no party has actually suggested. To that end, they propose:

a) Applying a 1 per cent annual wealth tax to families with fortunes over $20 million.

b) Cracking down on Tax Havens and closing tax loopholes.

c) Making web giants like Amazon, Google and Facebook pay their fair share of taxes as has been done by other countries.

d) Introducing a temporary COVID-19 Excess Profit Tax. This would, at least, double the tax rate on excess profits.

e) Pairing these programs with tough enforcement against tax evasion and penalties for millionaires and big corporations who try to avoid paying their fair share.

If most of these measures look familiar, it's because they are largely a warmed-over version of the very same handwavey promises they made in the last election, and they have the very same problems that they had then in large part because they, along with Singh's rhetoric, have mostly been lifted wholesale from the Bernie Sanders/Alexandria Ocasio-Cortez Democrat playbook, and don't necessarily fit into a Canadian context.

For example, the imposition of an annual wealth tax on family fortunes is unworkable in the Canadian tax system because unlike the American tax system, we tax individual incomes and not households. In order to tax family fortunes, we would need to build an entirely new tax system to capture this small amount or revenue the juice not being worth the squeeze. But this is what happens when you simply ape American talking points without thinking them through.

Cracking down of tax havens is the common refrain we keep hearing, under the assumption that there are just billions of dollars waiting to be scooped up that successive governments have simply been too lazy/cozy with the billionaire class (all tens of them) to bother with, which is simplistic nonsense. Tax havens are an incredibly complex problem to deal with, which this government has invested fairly heavily in combatting, and have been dealing with some of the necessary intergovernmental work of tax information treaties with foreign governments so that we can get proper disclosures of what are in those accounts. It's slow work, and can't be done with the flick of a switch (or the wave of a magic wand).

Likewise, promises to tax web giants like Amazon are easy to promise, but difficult to follow through on because they use foreign tax jurisdictions to shift their burden methods that have been largely legal until recently, and again isn't something that the CRA can simply swoop in and collect on. And while sure, France has instituted taxes on some of these web giants, it doesn't mean that they are actually collecting much on them or that they're not facing reprisals either.

The "Temporary COVID-19 Excess Profit Tax" is another notion that sounds easy, but is incredibly complex to administer, especially when you have to start with the assumption of just what constitutes "excess profit"? Yes, these kinds of taxes existed during the Second World War, but that was also in the context of massive tax increases across the board, and it was done as a way to ensure a modicum of social peace from that population, especially when there were certain industries that would do well in wartime like munitions or food supplies many of whom had their profits coming straight out of government contracts, none of which applies today. And with this context in mind, trying to decide what constituted "excess profit" was easy to game after all, if you tried to go for the historical average, you have to remember that before the war was the Great Depression; if you tried to determine what was a justifiable return on investment, that was easily manipulated.

This isn't the Second World War. Capital is much more mobile now, and the Tax Code is much more convoluted. We also have to remember that the economic contraction lasted only two months we have been in recovery since May, and it's going to be hard to attract investment when they have to worry about this tax where there is no articulated exit strategy from its "temporary" nature. Singh also told Power & Politics that he wanted to work with the Parliamentary Budget Officer to set the rate, which should set of loud alarm bells because that is explicitly not the PBO's function, and it would explicitly politicize his office in doing so.

If the issue is that hero pay got cut, there are better mechanisms to deal with it, such as using the Competition Bureau to investigate and punish these grocery chains for the apparent collusion they engaged in when it came to withdrawing that pay (something Liberal MP Nathaniel Erskine-Smith is pursuing). If the issue is that more people went to grocery stores because restaurants closed, or that there were higher prices because supply chain disruption triggered the laws of supply and demand, it's hard to consider this "profiteering." If this is about the morality of capitalism, then that's a broader discussion that this handwaving and fixation on supposed "easy solutions" (that are not easy at all) won't fix, and is not the same preoccupation in Canada as in American politics. If the NDP wants to propose solutions to help people in this pandemic, this suite of measures is not it.

Photo Credit: Maclean's