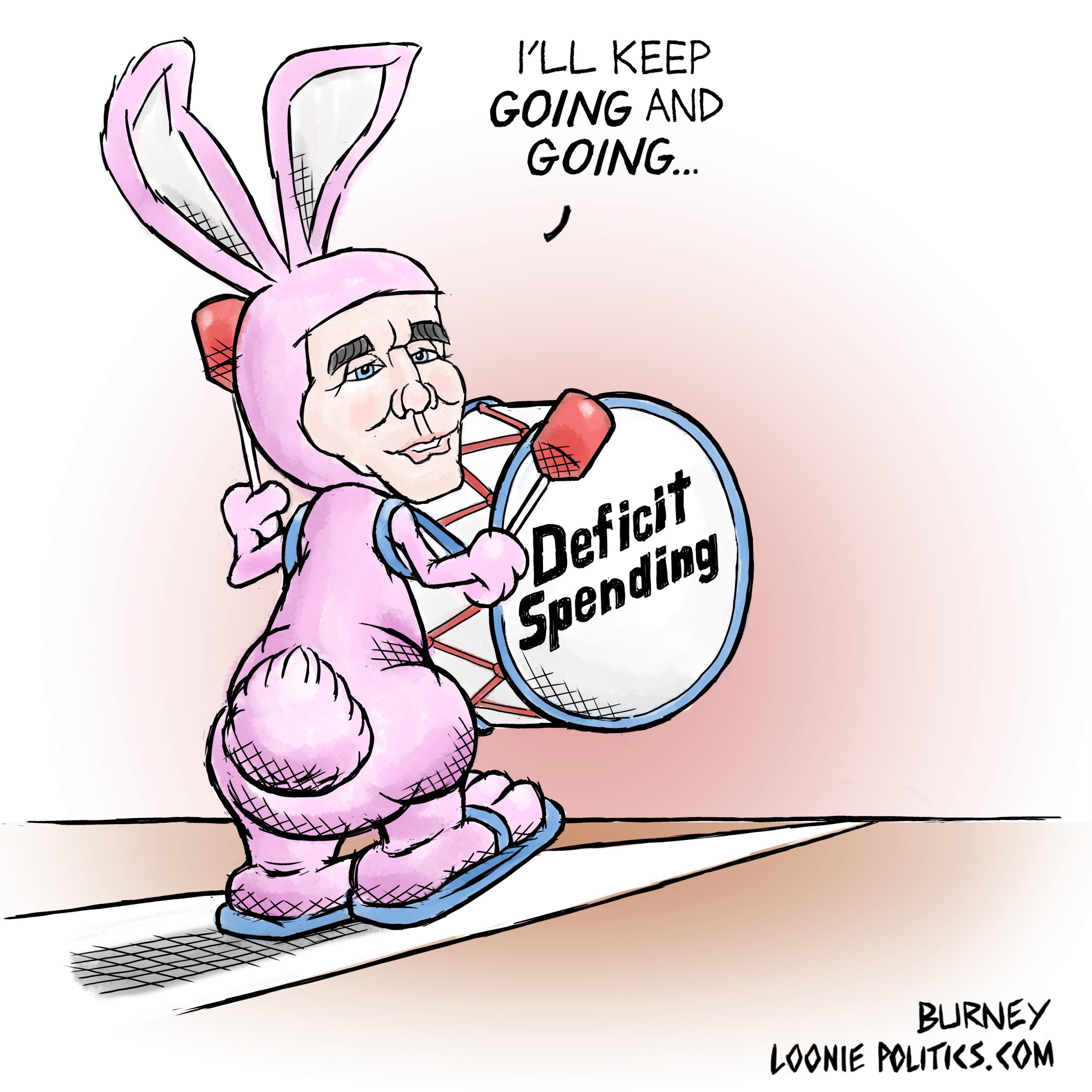

From its title, "Equality + Growth," it was easy to tell that Budget 2018 would be the latest in a long, long, long line of reminders of how socially progressive Justin Trudeau's government is. The ensuing commentary was just as predictable, lamenting the stress on the former over the latter, in both the budget's title and its content:

- Margaret Wente, The Globe & Mail: ". . . somehow I doubt that the magic incantation of the word "gender" is enough to win the hearts of middle-class women. Women, after all, want what men want: leadership in tough times, a steady hand and seriousness of purpose at the top, someone who will not make a complete hash of things that should be relatively easy to pull off."

- Andrew Coyne, National Post: "This is a budget that is much more about equality than it is growth. That, and pandering to every conceivable Liberal client group and policy cult: environmentalists, seasonal EI recipients, multiculturalism, official language groups, regional development, all the way to the media . . . And, of course, feminists."

- Anthony Furey, Toronto Sun: "For a supposedly financial document, it's rife with identity politics . . . The word gender appears 358 times. Choose another big issue, say, terrorism — that word doesn't appear once. It tells you something about priorities."

For the Opposition, crafting an appropriate response to a budget of this nature has its pitfalls. You can attack its social justice emphasis head-on, which is what the Liberals crave the most: the opportunity to accuse others of discriminatorily missing the point. Or you can present alternative measure, preferably the kind that do emphasize growth, instead of goodies for your own client groups and policy cults. Between existential threats to NAFTA, a moth-eaten tax code, household debt, and a generally weak investment climate, getting the Canadian economy to fire on all cylinders should be the top priority for all of Ottawa.

What could that budget actually look like? For a start, it would include any or all of the following:

Improved interprovincial and foreign credential recognition. A government announcement from November hailed a new website that would help dental technologists navigate the licensure and registration process. This is only the least the feds can do to help skilled workers. A job offer from a Canadian company, combined with certification in good standing from an occupational licensing body outside the destination province, should be sufficient for the right to work inside that province. For interprovincial migrants, all skilled trades should be recognized under the intergovernmental Red Seal program, ensuring uniformity of standards and quicker start dates. To put things in perspective, there are currently 56 occupations recognized under Red Seal, while the Ontario College of Trades governs . . . well, this many.

A new way of financing infrastructure. There are two key features of federal funding for major infrastructure and transportation projects: They are politically timed and politically allocated. Budget 2018 is no exception, pausing the distribution of billions in relevant funding until after next year. Upgrades to trade-enabling infrastructure, such as highways, railways and ports, cannot wait for the best photo opportunity. New legislation must narrow the definition of infrastructure to ensure that election-ready giveaways, such as for library shelving and scoreboards, are left out.

Removing disincentives for small businesses to scale up. As Globalive founder Anthony Lacavera notes in his and journalist Kate Fillion's October 2017 book How We Can Win, Canada's small business tax deduction encourages the creation of small businesses, but not their growth into larger ones that hire and invest more. "If your business starts generating a ton of revenue," he writes, "sorry you don't get the deduction anymore." To fix this, the government should take the advice of the C.D. Howe Institute and provide the deduction to "young, growth-oriented firms rather than simply all businesses that are small." This would not be as bold as cutting the corporate income tax rate altogether, but it would remove a hindrance for small business founders who are dreaming bigger.

Experts have been talking up these ideas for years, to no avail. After the last two easily distracted governments, it would take either a major economic crisis or a prime minister with the ambition of Brian Mulroney to put them into motion. Canada's economy may become more equal in the foreseeable future, but don't get your hopes up that it will become more powerful.

Photo Credit: Jeff Burney, Loonie Politics

Written by Jess Morgan